Automating Due Diligence: Tools and Trends for 2025

The Evolution of Due Diligence Automation

The Limitations of Traditional Due Diligence

Traditional due diligence was manual, slow, and heavy on paperwork. Teams sifted through stacks of documents, made endless calls, and relied on scattered data from multiple sources. This process often led to:

- Missed risks

- Inconsistent results

- Long turnaround times

The Need for Speed in Modern Markets

Fast-paced markets demand speed and accuracy. Manual methods can’t keep up with the volume and complexity of today’s business deals or regulatory requirements. Delays in due diligence cost money, create compliance gaps, and frustrate both internal teams and external partners.

How Automation Transforms Due Diligence

Automation changes the game:

- Speed: Automated systems scan thousands of records in seconds.

- Consistency: Standardized algorithms reduce human error and subjective judgment.

- Scalability: Handle more deals without a linear increase in resources.

- Better insights: Advanced analytics flag hidden risks early.

The Future of Due Diligence: Tools and Trends for 2025

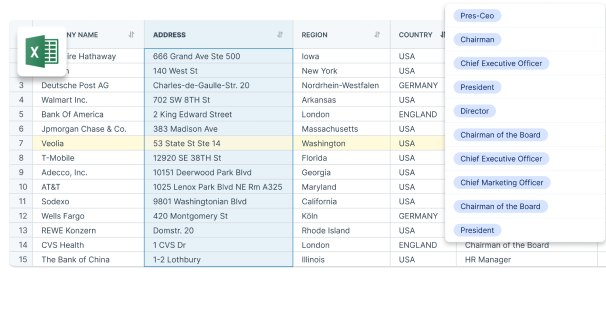

Automating Due Diligence: Tools and Trends for 2025 is not just a buzzword—it’s how leading companies are keeping pace with digital transformation in due diligence. Platforms like CompanyData.com now deliver verified company information instantly, integrating directly into workflows so teams act faster with confidence. Manual bottlenecks disappear; decisions become data-driven.

Key Technologies Shaping the Future of Due Diligence Automation

AI in Due Diligence: Smarter Risk Assessment and Decisions

Artificial Intelligence is changing how companies do due diligence. AI algorithms can quickly analyze large amounts of data, find inconsistencies, and uncover hidden risks that manual reviews often miss.

Example: Financial institutions use AI to run real-time anti-money laundering checks by cross-referencing transaction histories against global watchlists.

Here are some ways AI is being used in due diligence:

- Natural Language Processing (NLP): Tools that scan legal documents, news articles, and regulatory filings to spot red flags—such as litigation history or compliance breaches—within seconds.

- Predictive analytics: Models that estimate the likelihood of future issues based on patterns in historical data. For example, AI can assign risk scores to potential partners by analyzing their financials, press mentions, and executive backgrounds.

- Machine learning-driven insights: Helping compliance teams make better decisions with less guesswork.

RPA in Due Diligence: Taking Repetitive Work Off the Table

Robotic Process Automation (RPA) streamlines repetitive tasks that slow down due diligence projects.

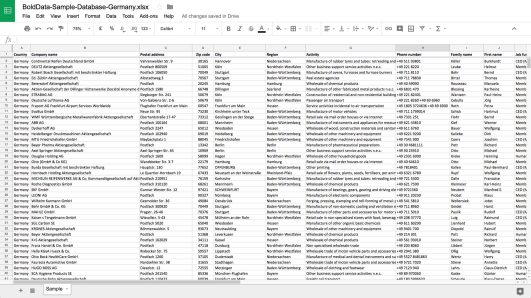

Example: Legal teams deploy RPAs to gather and update hundreds of company profiles for mergers or supply chain vetting.

Here are some ways RPA is being used in due diligence:

- Automated data collection: RPA bots pull company records, credit reports, and legal filings from multiple sources—24/7 and without errors.

- Data entry and validation: Bots check information across systems for consistency, reducing manual input mistakes.

- Workflow automation: RPA manages document routing for reviews and approvals, ensuring no steps are missed.

Blockchain for Due Diligence: Secure and Transparent Data Storage

Blockchain technology provides a decentralized ledger that guarantees data integrity.

Example: Cross-border M&A deals use blockchain to store proof of ownership documents, ensuring all parties have access to a single version of the truth.

Here are some ways blockchain is being used in due diligence:

- Immutable records: Every change is logged, making it impossible to tamper with past entries—essential for audit trails.

- Real-time verification: Stakeholders access up-to-date information instantly without relying on intermediaries.

- Enhanced trust: Smart contracts automate compliance checks and release documentation only when all criteria are met.

These technologies are not just passing trends—they actively reshape what’s possible in due diligence automation. As adoption grows across sectors, new tools continue to set higher standards for speed, accuracy, and transparency.

Sector-Specific Adoption Trends in Due Diligence Automation

Legal Tech AI Adoption: Transforming Legal Workflows

Legal teams have moved far beyond manual document review. AI-driven platforms now parse thousands of contracts, highlight key clauses, flag risk factors, and surface anomalies in minutes. This isn’t just about speed; it’s about consistency and depth.

- Document Review: Tools like Kira Systems and Luminance use natural language processing to extract obligations, deadlines, and unusual terms. This minimizes the risk of missing critical information hidden in large volumes of paperwork.

- Legal Research: Solutions such as ROSS Intelligence provide instant answers drawn from massive legal databases—cutting research time and improving accuracy.

- Drafting Assistance: Contract automation tools can draft NDAs or sales agreements using company-approved templates, reducing human error and freeing up legal talent for higher-value tasks.

- Workflow Optimization: AI-powered task management platforms automate intake forms, assign reviews, and track version history, keeping teams aligned.

Firms adopting these tools see faster client onboarding, reduced billable hours spent on rote tasks, and a lower risk of compliance gaps.

RegTech Compliance Solutions: Real-Time Risk Monitoring

Financial institutions and multinational corporations face mounting regulatory requirements. RegTech solutions step in with automated compliance checks built on robust data feeds.

- Real-Time Monitoring: Platforms like ComplyAdvantage and Actico track transactions against global watchlists, news feeds, and sanctions databases. Suspicious activity gets flagged instantly—no waiting for end-of-day reports.

- Automated Reporting: Regulatory filings are generated directly from business transaction data, ensuring that submissions are accurate and audit-ready.

- Ongoing Due Diligence: These systems monitor counterparties continuously—alerting teams to changes in ownership, new adverse media hits, or shifts in beneficial ownership structures.

The payoff is clear: regulatory adherence is no longer a reactive process but an embedded part of daily operations.

Both legal tech AI adoption and RegTech compliance solutions reflect a shift toward seamless integration of advanced technology across sector-specific due diligence workflows. New efficiencies are setting the pace for what’s expected across industries under pressure to move faster while staying compliant.

Emerging Roles and Skills for the Automated Due Diligence Era

Automation is changing what expertise looks like in due diligence. Two skill sets are now in high demand: AI implementation skills in due diligence and cybersecurity expertise for due diligence automation.

Key Skills Driving the Shift:

- AI Tool Deployment:

- Teams need professionals who understand both the technology and the business context. This means not just data scientists, but compliance officers and analysts who can evaluate, configure, and monitor AI models that flag risks or automate compliance checks.

For example, deploying an AI tool to scan thousands of supplier contracts requires someone who knows how to train the system on relevant risk indicators.

- Cybersecurity Knowledge:

- Due diligence automation tools often process sensitive ownership, financial, or regulatory data. Protecting this information from breaches is non-negotiable. Cybersecurity specialists are now critical stakeholders during tool selection and integration phases to ensure encryption, access controls, and audit trails are robust.

- Tasks include regular vulnerability assessments

- Implementing secure API integrations between platforms like CompanyData.com and internal systems

Emerging Job Titles:

- AI Due Diligence Analyst

- Compliance Automation Specialist

- Cyber Risk Manager

As companies turn to solutions like CompanyData.com for verified company intelligence integrated directly into CRMs or analytics stacks, these roles keep automated workflows secure, compliant, and aligned with business needs.

Realizing the Benefits of Automating Due Diligence by 2025

Automated due diligence is now driving a new standard for accuracy and efficiency across sectors. The shift to digital tools eliminates manual bottlenecks and unlocks a range of benefits that were out of reach with traditional, paper-heavy processes.

Key Benefits:

- Improved Accuracy and Consistency

- Automated systems follow strict logic, reducing the risk of human error in data extraction, verification, and reporting. Duplicate entries, missed red flags, or inconsistent documentation—common issues in manual checks—are minimized. For example, AI-powered validation tools flag discrepancies instantly, ensuring that every data point is checked against verified sources like those provided by CompanyData.com.

- Workflow Optimization Through Due Diligence Automation

- Automation standardizes workflows, making reviews faster and more reliable. Tasks such as background checks, document processing, and risk scoring are executed in real time. Teams can set up automated alerts for missing information or compliance gaps, streamlining approvals and keeping deals on schedule.

- Cost-Effectiveness in Automated Due Diligence

- Labor-intensive reviews once required large teams working overtime. Now, software handles bulk analysis at a fraction of the cost. Savings stem from reduced manual labor and faster contract finalizations—businesses close deals sooner while reallocating skilled staff to higher-value tasks.

Innovative companies are already reporting shorter onboarding times and fewer compliance backlogs as a result. As automation matures, these benefits will only compound.

Overcoming Challenges in Due Diligence Automation

Automation in due diligence faces two main challenges: data quality concerns and the ethical use of AI. No tool, no matter how advanced, can deliver reliable insights if it ingests fragmented or poor-quality data. Many organizations deal with inconsistent record formats, outdated entries, or incomplete ownership structures—problems that undermine trust and accuracy in automated results.

1. Data quality concerns in automated due diligence

Automated systems depend on clean, structured information. Integrating multiple data sources often exposes mismatched or duplicate records. Businesses can address these gaps by partnering with verified data providers like CompanyData.com that supply up-to-date and comprehensive company profiles, hierarchies, and financials.

2. AI ethics in due diligence automation

Algorithms used for risk scoring or fraud detection can inherit biases from historical data sets. Black-box models make it difficult to explain decisions to regulators or clients. Compliance frameworks now require transparency: explainable AI and regular audits of automated processes are becoming standard.

However, the integration of AI in due diligence also offers significant benefits despite these challenges. For a more in-depth understanding of the benefits, challenges, and impacts of AI due diligence, it’s essential to consider various perspectives.

A solid automated due diligence process is built on trustworthy data and responsible AI practices. Clear protocols for validating inputs and monitoring outputs keep both compliance teams and clients confident in the results.

The Future of Due Diligence: Balancing Technology with Human Expertise

Automating Due Diligence: Tools and Trends for 2025 will drive compliance teams to rely on AI, RPA, and blockchain for robust, real-time decision-making. Yet, data-driven tools are only part of the equation. Human expertise remains essential—interpreting red flags, making judgment calls, and ensuring ethical standards.

As future of automated compliance trends 2025 unfold, businesses will need teams who can both trust automation for speed and accuracy and intervene when nuanced analysis is required. This synergy sets the standard for risk management in an era defined by both innovation and accountability.