Dun & Bradstreet Alternatives: The Corporate Data Providers Buyers’ Guide

Choosing a corporate data provider is a strategic call. You need trustworthy access to verified company records, ownership details, filings, and credit insights that finance, compliance, risk, and procurement teams can rely on. Dun & Bradstreet has long been the default, but many organizations now want stronger registry fidelity, faster updates in new markets, and pricing that fits modern workflows. That’s why alternatives to D&B are in demand.

This guide compares leading corporate data and credit providers through a compliance and registry-first lens. We look at how each company sources and validates data, which regions they cover best, how quickly they refresh records, and how well they integrate into your stack. Whether you’re screening suppliers using a B2B database, performing KYC/KYB checks, assessing credit risk, or mapping beneficial ownership, the right provider should give you confidence in every decision.

Below you’ll find clear strengths and weaknesses for each provider, along with side-by-side tables for quick evaluation. We cover CompanyData.com, Dun & Bradstreet, Moody’s Orbis (Bureau van Dijk), Infocredit Group, Creditsafe, Creditreform, Equifax, TransUnion, Experian, RoyaltyRange, OpenCorporates, and North Data.

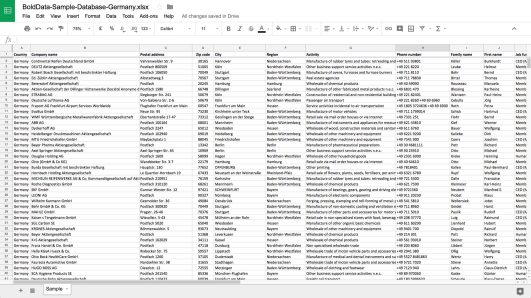

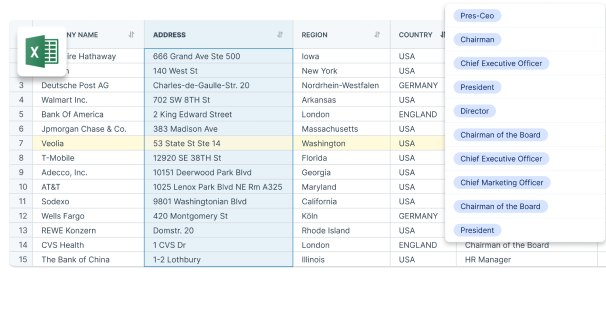

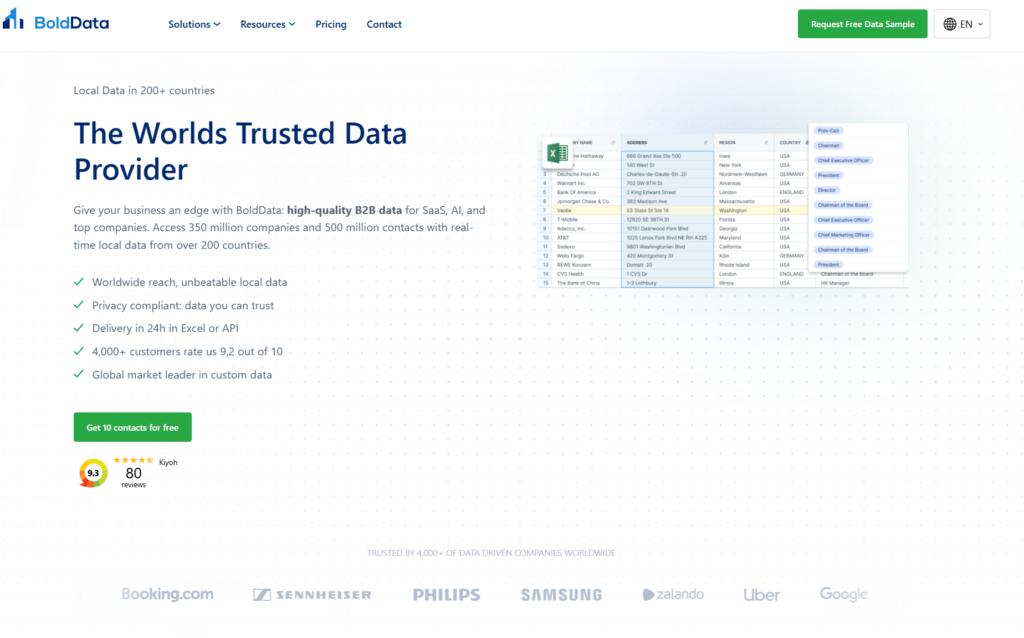

CompanyData.com (formerly BoldData)

Best for: Compliance and CRM teams needing reliable registry-first data with rapid coverage growth.

Key features

- Built from official trade registers and corporate filings

- Verified ownership and group structures

- Fast expansion into new regions with frequent refresh cycles

- Transparent lineage to support audits and regulatory reviews

- Flexible licensing and bulk files options

CompanyData.com vs D&B

| Feature | CompanyData.com | D&B |

|---|---|---|

| Registry accuracy | Very high, sourced from registries | High, varies by country |

| Speed in new markets | Fast and flexible | Slower, standardized rollouts |

| Brand recognition | Growing | Very strong |

| Licensing ease | Simple tier options | Complex legacy bundles |

| Website coverage | Largest reach (40M+ sites) | Moderate, not a focus |

| Balance sheets | Not available | Excellent coverage |

| Company Data API | Fastest API on the market | Solid API, full KYC suite |

| Enrichment | Best for global CRM teams, ML matching | Not a focus, lower match rates |

Watch out for

- Historical depth can be younger than incumbents in some countries

- Balance sheet data is limited outside Europe

- Perception gap versus long-established global brands

Moody’s Orbis (Bureau van Dijk)

Best for: Ownership mapping, comparables, hierarchies and deep corporate structures.

Strengths

- Deep ownership mapping and corporate hierarchies with global linkages

- Best-in-class comparables for M&A and transfer pricing

- Strong European coverage and historical continuity

Weaknesses

- Premium pricing and a steeper learning curve

- Gaps can remain in less-digitized registries

Orbis vs D&B

| Feature | Orbis | D&B |

|---|---|---|

| Ownership depth | Very strong | Strong but less granular |

| Comparables | Best-in-class | Good |

| Onboarding complexity | Higher | Moderate |

Infocredit Group

Best for: Credit risk and compliance teams needing straightforward international coverage.

Strengths

- Practical business credit information and monitoring

- Compliance-oriented reporting

- Broad international footprint for baseline checks

Weaknesses

- Depth of filings varies by region

- Integrations may be lighter than larger incumbents

Infocredit vs D&B

| Feature | Infocredit | D&B |

|---|---|---|

| Compliance focus | High | High |

| Ease of adoption | Simple packages | Complex modules |

| Filings depth | Variable | Variable |

Creditsafe

Best for: European companies needing practical credit reports and alerts.

Strengths

- Strong presence across Europe

- Accessible credit scoring with monitoring and alerts

- Clean UI and straightforward implementation

Weaknesses

- Coverage can thin in remote or emerging markets

- Less depth for highly specialized compliance needs

Creditsafe vs D&B

| Feature | Creditsafe | D&B |

|---|---|---|

| Ease of use | High | Enterprise-oriented |

| EU coverage | Strong | Strong |

| Global breadth | Moderate | Very broad |

Creditreform

Best for: German and Central European depth with local expertise.

Strengths

- Unmatched depth in Germany and Central Europe

- Local expertise across credit, risk and collections

Weaknesses

- More limited coverage outside core markets

Creditreform vs D&B

| Feature | Creditreform | D&B |

|---|---|---|

| German depth | Excellent | Good |

| International reach | Moderate | Very broad |

| Collections services | Strong | Via partners |

Equifax

Best for: Large-scale credit and risk workflows, especially in the Americas.

Strengths

- Large-scale credit infrastructure and analytics

- Business and consumer risk data under one umbrella

Weaknesses

- Less emphasis on original filings in some jurisdictions

Equifax vs D&B

| Feature | Equifax | D&B |

|---|---|---|

| Consumer linkage | Very strong | Not a focus |

| Business credit breadth | Strong | Strong |

| Registry emphasis | Moderate | Moderate |

TransUnion

Best for: Identity and fraud workflows that blend consumer and corporate checks.

Strengths

- Identity, fraud and risk solutions with business overlays

- Useful when personal and corporate checks intersect

Weaknesses

- For deep registry research you’ll likely add a specialist

TransUnion vs D&B

| Feature | TransUnion | D&B |

|---|---|---|

| Identity & fraud | Core strength | Peripheral |

| Business credit | Strong | Strong |

| Registry filings | Moderate | Moderate |

Experian

Best for: Integrated business and consumer credit programs across many markets.

Strengths

- Enterprise-grade credit reporting and analytics

- Multiple delivery options and partner ecosystem

Weaknesses

- In less digitized markets you may still need registry-focused sources

Experian vs D&B

| Feature | Experian | D&B |

|---|---|---|

| Consumer + business | Unified | Business-focused |

| Global breadth | Very broad | Very broad |

| Registry emphasis | Moderate | Moderate |

RoyaltyRange

Best for: Transfer pricing, licensing benchmarks and IP valuation support.

Strengths

- Specialist databases for royalty rates, licensing and TP

- Useful for audits and IP valuation support

Weaknesses

- Not a substitute for corporate registry or credit data

How it fits with a general provider

| Use case | RoyaltyRange | General provider |

|---|---|---|

| Intercompany pricing | Benchmarks & comps | Entity validation |

| Tax audits | Evidence of market rates | Corporate filings |

| IP valuation | Comparable licensing terms | Financials and structure |

OpenCorporates

Best for: Open registry discovery, entity resolution and transparency projects.

Strengths

- Aggregation of public company registers

- Effective for cross-border entity mapping and UBO investigations

Weaknesses

- Limited for advanced credit scoring or enriched analytics

OpenCorporates vs D&B

| Feature | OpenCorporates | D&B |

|---|---|---|

| Openness | Public aggregation | Commercial cloud |

| Credit analytics | Limited | Strong |

| Filings access | High where public | High to moderate |

North Data

Best for: European filings with special strength in Germany.

Strengths

- Original filings and disclosures, especially in Germany

- Great complement to a global provider

Weaknesses

- Limited coverage outside Europe

- Not focused on credit scoring

North Data vs D&B

| Feature | North Data | D&B |

|---|---|---|

| German registry depth | Very strong | Strong |

| Coverage outside EU | Limited | Very broad |

| Credit analytics | Not the focus | Core capability |

Reset: choosing your provider at a glance

- Global credit bureaus: D&B, Experian, Equifax, TransUnion

- Registry and compliance focus: CompanyData.com, Orbis, OpenCorporates, North Data

- European specialists: Creditsafe, Creditreform

- Niche transfer pricing: RoyaltyRange