The Future of Automated KYC and KYB Verification Processes in B2B Markets

A sleek blue digital interface showing automated KYC and KYB verification with icons of documents, ID cards, and secure data analytics.

The Future of Automated KYC and KYB Verification Processes in B2B Markets is reshaping how companies confirm the legitimacy of both customers and business partners.

KYC (Know Your Customer) is the process of verifying the identity of individuals, while

KYB (Know Your Business) focuses on validating businesses, their ownership structures, and their financial standing.

Both processes are critical for preventing financial crime, money laundering, and fraud—especially in B2B markets where transactions involve multiple stakeholders and higher value deals.

Manual verification is slow, costly, and prone to human error. With rising regulatory demands and a push for digital operations, automated KYC and automated KYB are now essential for compliance and risk management.

This article explores what’s driving adoption of automated B2B verification, the technologies powering these changes, current market trends, and what the future of KYC/KYB looks like as AI-driven solutions become standard.

The Regulatory Landscape Shaping KYC and KYB in B2B Markets

The Regulatory compliance defines the boundaries within which B2B businesses must operate, especially when it comes to verifying both clients and business partners.

Key Regulations Shaping the Field

1. AML6 (Sixth Anti-Money Laundering Directive)

AML6 brings stricter requirements for identifying beneficial owners and reporting suspicious activities. For B2B markets, this means more rigorous due diligence on company structures, cross-border transactions, and ultimate beneficial ownership (UBO) disclosures.

2. DAC7 (EU Directive on Administrative Cooperation)

DAC7 extends reporting obligations to digital platforms, covering a wider range of B2B transactions. Platforms must now collect, verify, and report detailed information about sellers—pushing for more granular KYB processes.

Emerging Rules Reshaping Verification

1. Digital Services Act

The DSA increases pressure on platforms to implement robust identity verification, especially around business users offering goods or services online. Automated KYC/KYB tools are critical for meeting these new obligations at scale.

2. MiCA (Markets in Crypto-Assets Regulation)

MiCA introduces mandatory KYC/KYB checks for crypto service providers in the EU. This regulation is driving innovation in automated onboarding solutions that handle both individual and business entity verification.

Obligations for Transparency and Fraud Prevention

Businesses face mounting demands:

1. Maintain transparent records of all counterparties.

2. Detect and report suspicious activity instantly.

3. Prevent fraud by validating both personal identities (KYC) and corporate entities (KYB) before any transaction or partnership.

“Effective compliance isn’t just about ticking boxes—it’s about building trust with partners and regulators while reducing risk.”

Regulations like AML6, DAC7, the Digital Services Act, and MiCA not only set the bar for what’s expected—they accelerate demand for smarter, automated verification across B2B markets. This regulatory momentum is pushing businesses to adopt technology that keeps pace with evolving risks and obligations.

Technological Advancements Driving Automated Verification

Automation technology is transforming how B2B companies handle KYC and KYB. Artificial intelligence and machine learning are now the backbone of identity verification, moving checks from slow, manual reviews to real-time decisions.

1. Artificial Intelligence & Machine Learning

AI-driven systems analyze thousands of data points in seconds, flagging inconsistencies or suspicious activity that would slip past human reviewers. Machine learning models adapt with every new verification, improving detection of fraudulent patterns over time. This results in fewer false positives and less friction for legitimate business clients.

2. Biometrics

Biometrics such as facial recognition, fingerprint scanning, and voice identification add another layer of certainty during onboarding. These tools confirm that the person submitting documents is who they claim to be—minimizing impersonation risks.

Example: A B2B platform can use facial matching to compare a live selfie with a government-issued ID, stopping account creation if the match fails.

3. Optical Character Recognition (OCR)

OCR extracts details from documents—business registrations, utility bills, certificates—without manual data entry. Automation technology pulls names, registration numbers, addresses, and dates directly into compliance systems, cutting onboarding times from days to minutes.

Example: An automated KYB workflow uses OCR to capture company director names from official filings and cross-checks them against watchlists instantly.

These advancements allow businesses to process higher volumes at scale while maintaining compliance standards. Reliable automation means faster onboarding for customers and less exposure to regulatory or reputational risk.

Integration of KYC and KYB Processes for Streamlined Onboarding

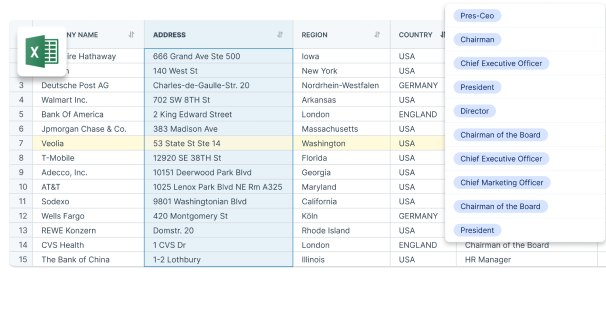

Integrated verification solutions are reshaping how B2B companies manage compliance and risk. By merging individual KYC checks with business entity verification (KYB), organizations remove silos in their onboarding process. Instead of managing two separate verification flows, businesses can now authenticate both the identity of decision-makers and the legitimacy of corporate entities in a single, unified sequence.

This approach delivers:

- Faster onboarding timelines: Clients avoid redundant document submissions. A seamless flow means less friction, fewer manual reviews, and quicker approvals.

- Improved compliance outcomes: Integrated solutions catch mismatches between personal and corporate data instantly. This supports regulatory obligations while reducing false positives or missed red flags.

- Consistent data quality: A unified system ensures that information about individuals and their associated businesses is cross-referenced in real time, boosting accuracy for ongoing monitoring. This aligns with the six dimensions of data quality which include accuracy, completeness, consistency, reliability, relevance, and timeliness.

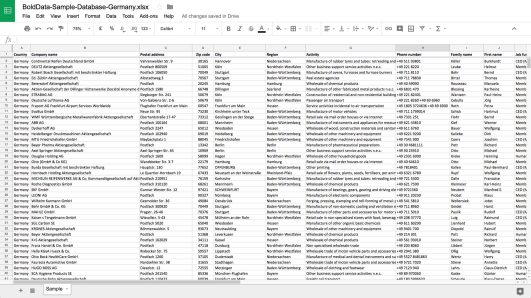

Companies like CompanyData.com illustrate the power of integrated verification by linking ownership structures, hierarchies, and contact details directly to both KYC and KYB steps. This level of detail reduces risk at every stage of the relationship.

The future of automated KYC and KYB verification processes in B2B markets lies in this tight integration—where every check feeds into a single source of verified truth, setting a new standard for trust and operational efficiency.

Market Trends Driving Adoption of Automated KYC/KYB Solutions

Market growth in automated KYC and KYB solutions continues to accelerate. Spending trends show a consistent increase, with recent market research reporting that global investments in digital verification technologies are expected to surpass $20 billion by 2026. While financial services remain the largest adopters, sectors like e-commerce, real estate, and logistics are now prioritizing automated compliance tools.

Key trends fueling adoption:

Stricter regulatory enforcement: Organizations face mounting pressure from authorities to maintain robust compliance frameworks. Regulatory crackdowns and high-profile enforcement actions have driven even non-financial businesses to adopt advanced verification tools.

Age verification requirements: Online platforms selling restricted goods—such as alcohol, vaping products, or gambling services—must implement rigorous age checks. Automated identity and business verification streamline compliance without slowing customer acquisition.

Shift toward digital onboarding: As companies digitize customer journeys, manual checks become bottlenecks. Automation supports instant onboarding, which is now a baseline expectation for B2B clients and partners.

Demand for scalable solutions: Rapid business expansion into new regions requires scalable KYC/KYB processes that can adapt to diverse regulatory environments and languages.

“Automated KYC/KYB is no longer just a financial sector concern—it’s now central to risk management strategies across industries,” says a recent Deloitte study on compliance technology.

These trends set the stage for new developments in the compliance landscape, especially as AI-powered analytics begin shaping future security and regulatory approaches.

Future Outlook: AI-Powered Compliance, Security Enhancements, and Global Harmonization Efforts

AI-driven compliance solutions are pushing KYC and KYB verification into a new phase. Businesses now require systems that don’t just check boxes—they need platforms capable of continuous monitoring, real-time alerts, and actionable insights across borders.

Harmonized Global Regulatory Standards

Regulators are moving toward unified frameworks. The goal: reduce friction for cross-border B2B transactions while addressing issues like money laundering, tax evasion, and terrorist financing.

Initiatives such as the Financial Action Task Force (FATF) guidelines and the push for interoperable digital ID schemes set the stage for global alignment.

As more countries adopt similar standards, onboarding clients from different jurisdictions gets easier—no more juggling fragmented local rules.

Advanced Analytics for Fraud Detection

AI-powered analytics dig deeper than legacy rules-based systems. They flag suspicious patterns in real time—unusual payment flows, fake ownership structures, or synthetic identities.

Machine learning models adapt to new threats as they emerge, making fraud detection smarter with every transaction analyzed.

Companies gain the advantage of predictive risk assessment rather than reacting after the fact.

Security Enhancements Through Technology

Biometrics and behavioral analytics are making identity spoofing much harder. Deepfake detection tools and continuous authentication keep threat actors at bay.

Automated document verification using computer vision weeds out forged paperwork before it enters your workflow.

With these layers in place, trust becomes a default setting—not an exception.

AI-driven compliance solutions empower companies to move faster without sacrificing security or regulatory rigor. As international standards continue to align and analytics get sharper, B2B onboarding will become less of a headache and more of a competitive advantage.

Conclusion

To stay competitive in B2B markets, we need to move quickly and comply with regulations. Manual verification processes can’t keep up with the fast-paced global business environment or the constantly changing regulations. Integrated, AI-driven KYC and KYB automation is no longer a choice—it has become a strategic necessity.

The future of KYC KYB automation lies in proactive compliance, faster deal-making, and global expansion without compromising security. Businesses that invest in advanced verification technology will be at the forefront as regulations become stricter and digital transformation speeds up.